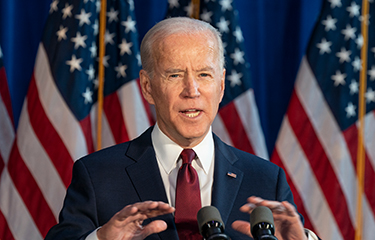

With the U.S. Electoral College certifying President-elect Joe Biden’s victory over President Donald Trump, the country has continued the transition of power, which will culminate in the 20 January inauguration.

As the Biden administration continues to announce its cabinet picks, analysts are expecting that the country’s current stance on international trade likely won’t shift nearly as much.

Trade issues are at the front-of-mind for many seafood companies, as ongoing trade issues with multiple foreign countries have caused difficulties for exporters. The ongoing trade war in China instigated by Trump in 2018, for instance, had a significant impact on the industry, with some species seeing massive drops in exports to China.

Those trade issues won’t be shifting much in the early days of a Biden presidency, based on comments the president-elect has made, according to analysts. Biden has said domestic issues, like a clean energy infrastructure bill, will take priority in the early days of his presidency.

“He said he is going to prioritize domestic matters over international trade deals,” Holland and Knight Trade Attorney Nasim Fussell said. Fussell has served in numerous trade-related roles, including serving as the chief international trade counsel for the U.S. Senate Committee on Finance, and was a part of trade negotiations between the U.S. and Canada, Mexico, Japan, China, and the United Kingdom.

Whether that means certain Section 301 tariff exclusions that apply to goods from China will be allowed to lapse is still unknown, Fussell said. The United States Trade Representative (USTR) has in the past extended certain exclusions that pertain to seafood, but those extensions are nearing their end.

“Obviously, the imminent issue is what happens to the existing Section 301 exclusions,” National Fisheries Institute (NFI) Vice President of Government Affairs Robert DeHaan told SeafoodSource. “There has been recent congressional support, in the form of several bipartisan letters, for a straight extension of all exclusions. A large coalition of groups, including NFI, advocated for this policy. But Congress this year is unlikely to move legislation that would compel USTR to extend these exclusions or offer a new exclusion process for companies affected by the dispute.”

Some of the seafood products that have been granted exclusions include haddock, sole, and king crab. If the exclusions are allowed to lapse, those products would be back on the hook for a 25 percent tariff. In the wake of a year where the seafood industry has been hampered heavily by the effects of the COVID-19 pandemic, introducing yet another complication for the industry that adds little benefit to trade negotiations doesn’t make sense, DeHaan said.

“Temporarily extending tariff relief for businesses would not really advantage China in any 2021 negotiations, but it would make a big difference for seafood companies struggling through the pandemic – the most serious threat to their businesses since 9/11,” he said.

Another trade matter that is unlikely to see much progress in the early days of the Biden presidency is the ongoing dispute between the European Union and the U.S. regarding subsidies given to respective resident aircraft manufacturers Airbus and Boeing.

In October, the World Trade Organization ruled that the E.U. could impose USD 4 billion (EUR 3.2 billion) in tariffs against the U.S. as a countermeasure to illegal subsidies given Boeing, an American aircraft maker.

The case follows a similar move by the U.S. in October 2019, when – in response to subsidies granted to European aircraft manufacturer Airbus – the Trump administration imposed retaliatory tariffs on E.U. exports worth USD 7.5 billion (EUR 6.1 billion).

Fussell said she doesn’t expect a resolution on the issue in early 2021, largely because other pressing matters like COVID-19 will take up a great deal of the new administration's attention.

“I don’t see the likelihood being very high for a resolution early in 2021, just simply due to logistics,” she said.

Fussell predicted the most pressing issues facing the new Congress and Biden administration will likely be tackling the recovery from COVID-19, and the ongoing trade issues with China.

“I think that these are two very prominent spaces that the next Congress and the incoming administration will be focused on, and I think there are options for bipartisanship there,” she said. “On trade specifically, I think pandemic recovery will drive some bipartisanship on trade specific issues.”

How those trade issues will impact the seafood industry remains to be seen.

In addition to the ongoing trade issues with the E.U. and China, a recent U.S. Treasury report that claims Vietnam manipulated currency illegally has added fuel to a developing USTR Section 301 investigation.

The investigation, initiated in October, is looking at Vietnam’s use of illegal wood, and its “acts, policies, and practices that may contribute to the undervaluation of its currency and the resultant harm caused to U.S. commerce,” a USTR press release states.

Depending on the result of the USTR Section 301 investigation, it's possible that Section 301 tariffs could be added on to Vietnamese goods. That could be a blow to the country’s seafood industry, which through November of this year has sent USD 1.49 billion (EUR 1.23 billion) worth of seafood, up 10.4 percent year-on-year, to the U.S.

Photo ocurtesy of lev radin/Shutterstock