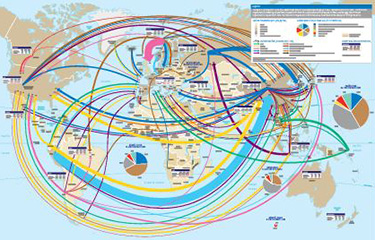

Already firmly established as the world’s most-traded animal protein, with commerce valued at 3.6 times the size of beef, five time that of pork, and eight times greater than poultry, the global seafood trade flow added a further USD 13 billion (EUR 13.4 billion) to its value in 2021, climbing to a new high of USD 164 billion (EUR 169 billion), according to the latest industry report compiled by Rabobank.

According to the Dutch multinational banking and financial services company’s “Global Seafood Trade: The Decade’s Winners Grow in Influence,” released 13 October, premium aquaculture – in particular salmon and shrimp – has been a driving force behind this growth.

"Seafood trade has experienced one of the more-volatile periods in recent history. With a possible macroeconomic downturn, more uncertainty is expected," Rabobank said in its report. "However, we still expect the recent winners - salmon and shrimp - to keep growing in the coming years. These two farmed species have proven their agility during COVID and benefitted from the subsequent demand increase."

Fueled by the growing demand for healthy and convenient protein, the salmon industry has seen accelerated growth since 2016, Rabobank found. In the pre-pandemic years 2013 to 2019, salmonids added USD 4.8 billion (EUR 4.9 billion) in trade value, with the EU-27/United Kingdom and United States adding USD 1.9 billion (EUR 2 billion) and USD 1.8 billion (EUR 1.9 billion) respectively. In 2020, overall trade value dropped by 8.4 percent year-on-year, but growth returned in 2021.

The EU-27 and United Kingdom continued to be the top global consumer of salmon last year, accounting for 41 percent of total imports. At the same time, the region’s import value increased by 14 percent, representing the highest year-on-year growth since 2016. The U.S. market experienced all-time highs in the same year as salmon imports rose to 505,571 metric tons (MT), and the value of these imports increased 27 percent – the highest growth in a decade.

Rabobank Seafood Analyst Novel Sharma, who co-wrote the report, said that post-pandemic, the salmon trade’s value has been fueled by high prices, brought by increased demand and limited supply growth. Sharma also suggested that the expansion of volumes “will be essential for continued growth.”

The global shrimp trade, meanwhile, has added USD 7.6 billion (EUR 7.8 billion) in trade value since 2013, driven by high demand and the ability to quickly expand its capacity. In 2021, it was valued at a total USD 24 billion (EUR 24.7 billion), making it the most-traded seafood species. The United States and China are the two leading shrimp importers, together accounting for 1 million MT of product.

Having contracted by 4.8 percent between 2019 and 2020, the shrimp trade bounced back in 2021, with the global volume and value rising 14 percent and 19 percent, respectively. The U.S. market recorded USD 8 billion (EUR 8.2 billion) in shrimp imports, up 24.2 percent from 2020, and China brought in USD 4.8 billion (EUR 4.9 billion) worth of products, which was still below pre-pandemic levels.

“In 2021, shrimp demand benefited from the reopening of the economy and increasing foodservice consumption, supplemented by high retail consumption,” the report said.

However, Rabobank has since observed an “inflection point,” with a significant drop in prices occurring in the first half of 2022. Prices have been dropping since the second quarter of 2022, while feed, freight, and energy costs remain high, impacting farmer profitability.

“This falling demand is likely to cause a short-term trade decline,” Sharma said. “Still, we do believe in shrimp-industry growth. The industry is support by strong, long-term demand, given shrimp’s position as a healthy and convenient seafood product with universal appeal.”

Rabobank said the United States’ seafood market has fully recovered from the COVID-19 pandemic and is now the world’s fastest-growing market for seafood imports, with imports valued at USD 28 billion (EUR 28.9 billion) last year.

This demand is being driven by health- and sustainability-conscious consumers, particularly among millennials and baby boomers, with millennials accounting for more than USD 200 billion (EUR 206.1 billion) in purchasing power, and the latter demographic comprising 77 million people.

Sharma said the U.S. seafood trade “recovered more than expected” in 2021 due to a combination of sustained at-home consumption and strong foodservice recovery.

“These factors led to peak imports for many species and an increase in import market share of high-value species,” Sharma said. “We expect long-term seafood demand to continue rising in the U.S.”

However, in the shorter-term, Sharma said the value of imports will come down from their 2021 peak and normalize for the next two to three years, primarily due to a looming recessionary environment and high inflation, with high prices alienating a certain portion of consumers. However, the growth of at-home consumption since the pandemic, combined with recessionary consumer spending behavior, could mitigate the decline, Rabobank found.

“We expect consumers to pivot more to retail channels, compensating for foodservice declines,” it said.

The Chinese market, meanwhile, is gradually returning to pre-pandemic import levels.

Between 2013 and 2019, the total value of its seafood imports grew from about USD 8 billion (EUR 8.2 billion) to USD 18 billion (EUR 18.5 billion), with premium species like shrimp, crab, and salmonids driving the growth. During the first year of COVID, these imports contracted by 17.5 percent compared with 2019, but then rebounded in 2021 by 15.6 percent.

In value terms, China’s imports totaled USD 17 billion (EUR 17.5 billion), which was the third-highest globally, while its 2 million metric tons of imports by volume was the second-highest total worldwide in 2021.

China’s Ministry of Agriculture and Rural Affairs recently announced 14th Five-year Plan for National Fishery Development aims to increase its aquaculture production to meet the domestic demand, including recirculation and offshore farming, but Rabobank said it does not expect a significant increase in volumes in the short-term.

“Therefore, we anticipate limited impact on trade flows,” Sharma said. “For now, COVID-19 restrictions will continue to impact the market. However, we expect these measures to be temporary, and imports should return to normal levels in the long-term.”

Rabobank said the seafood trade “has experienced one of the more-volatile periods in recent history,” and with a possible macroeconomic downturn, more uncertainty is expected. However, it anticipates the salmon and shrimp trades will continue growing, as they both proved their agility during the pandemic and benefited from the subsequent increase in demand.

It also maintains that the United States and China still have “enormous potential to continue shaping global seafood trade flows and will be key drivers in the near- and medium-term.”

Image courtesy of Rabobank