Bergen, Norway-headquartered Lerøy Seafood Group (LSG) experienced solid biological performance across its salmon- and trout-farming operations in the first quarter of this year, but revenues and EBIT in its Farming and Wild Catch segments suffered year-over-year drops, according to CEO Henning Beltestad.

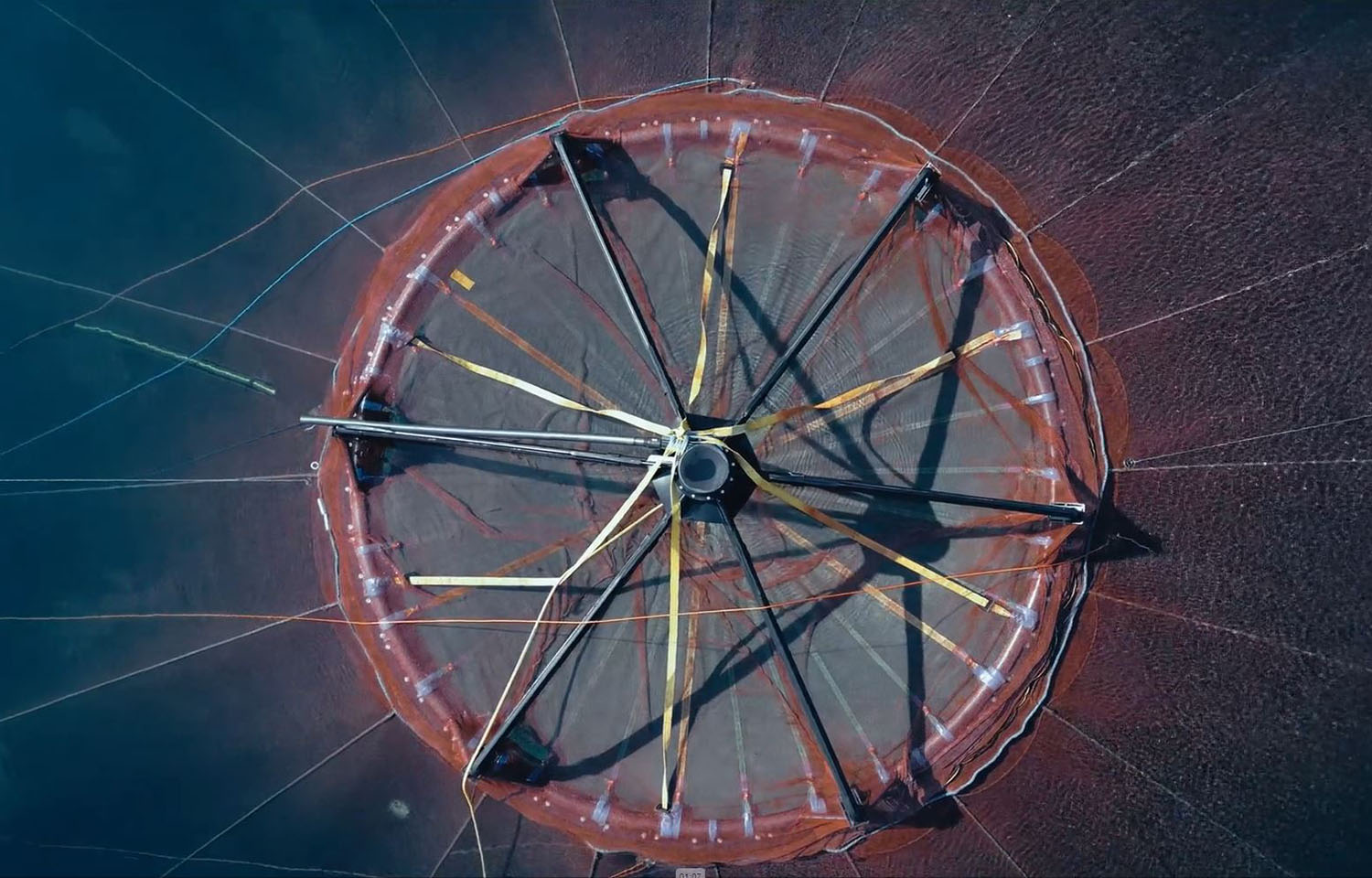

Delivering the group’s Q1 2024 results on 15 May, Beltestad confirmed that shielding technology LSG has introduced to support fish health and welfare, including submerged cages and semi-closed containment systems, has shown promising biological results, including a “minimal need” for sea lice treatments.

Year over year, LSG’s growth rates spiked 9 percent, mortality dropped 24 percent, and lice treatments dropped 56 percent in Q1, with all of these metrics marking the best the group has seen in five years, Beltestad said.

“These are exceptional improvements in these key drivers for improving fish health,” he said. “We are on track with our implementation of shielding technology. The results so far have been really good. We are on target with 20 percent of our fish shielded as of April 2024 and targeting 30 percent to 35 percent by the end of 2024. So far, everything is going well.”

Beltestad also highlighted that despite sea temperatures having been very cold in Norway, Lerøy’s farmed fish have continued to grow well.

“We are really satisfied to see the performance and improved biological status. We expect to see more improvements going forward with higher average weights, better quality, and a much better fish health situation. It’s been a real turnaround,” he said.

In Norway, Lerøy’s Farming segment comprises three farming regions: Lerøy Aurora, located in Troms and Finnmark; Lerøy Midt, located in Nordmøre and Trøndelag; and Lerøy Sjøtroll, located in Vestland.

Beltestad said that Lerøy Sjøtroll particularly improved its biological performance after a weak 2023. It had low standing biomass at the start of the year but has built this up considerably during the first quarter.

“It has been a very positive start to 2024, with the expectation for clear improvements from smolt quality, new farming technology, and increased production of trout. The cost level for 2024 is expected to be the same as for 2023 but with significant year-over-year reductions in the second half of 2024,” he said.

At the end of Q1 2024, Lerøy Sjøtroll had two facilities using submersible technology and one with shielding technology, with the group reporting lower mortality levels and treatments.

LSG’s Farming segment as a whole achieved revenues of just under NOK 2.5 billion (USD 233.4 million, EUR 214.8 million) in Q1, down from the NOK 2.6 billion (USD 242.8 million, EUR 223.2 million) recorded in the same period a year ago. Its operational EBIT was NOK 576 million (USD 53.8 million, EUR 49.5 million), compared to NOK 742 million (USD 69.3 million, EUR 63.8 million) in Q1 2023. The segment harvested 26,000 metric tons (MT) during the quarter, which was down 8 percent year over year.

Its Wild Catch segment reported revenues of NOK 957 million (USD 89.4 million, EUR 82.2 million), which was NOK 122 million (USD 11.4 million, EUR 10.5 million) less than Q1 2023 totals. Its operational EBIT slipped NOK 42 million (USD 3.9 million, EUR 3.6 million) to NOK 187 million (USD 17.5 million, EUR 16.1 million). In total, LSG caught 24,093 MT of fisheries products in the quarter, compared to 25,269 MT a year previously.

Moving forward, the company confirmed the segment will be further challenged by ...