Nine years after starting the planning process to farm salmon in the open ocean off the coast of New Zealand, New Zealand King Salmon (NZKS) has received full governmental permission to proceed.

NZKS produces premium king salmon sold through multiple brands, including Ōra King, Regal, Southern Ocean, and Omega Plus. The latest approval will allow it to farm king, also known as Chinook salmon, seven kilometers off the coast of Cape Lambert, New Zealand, in the Cook Strait, in an operation it has dubbed Blue Endeavor.

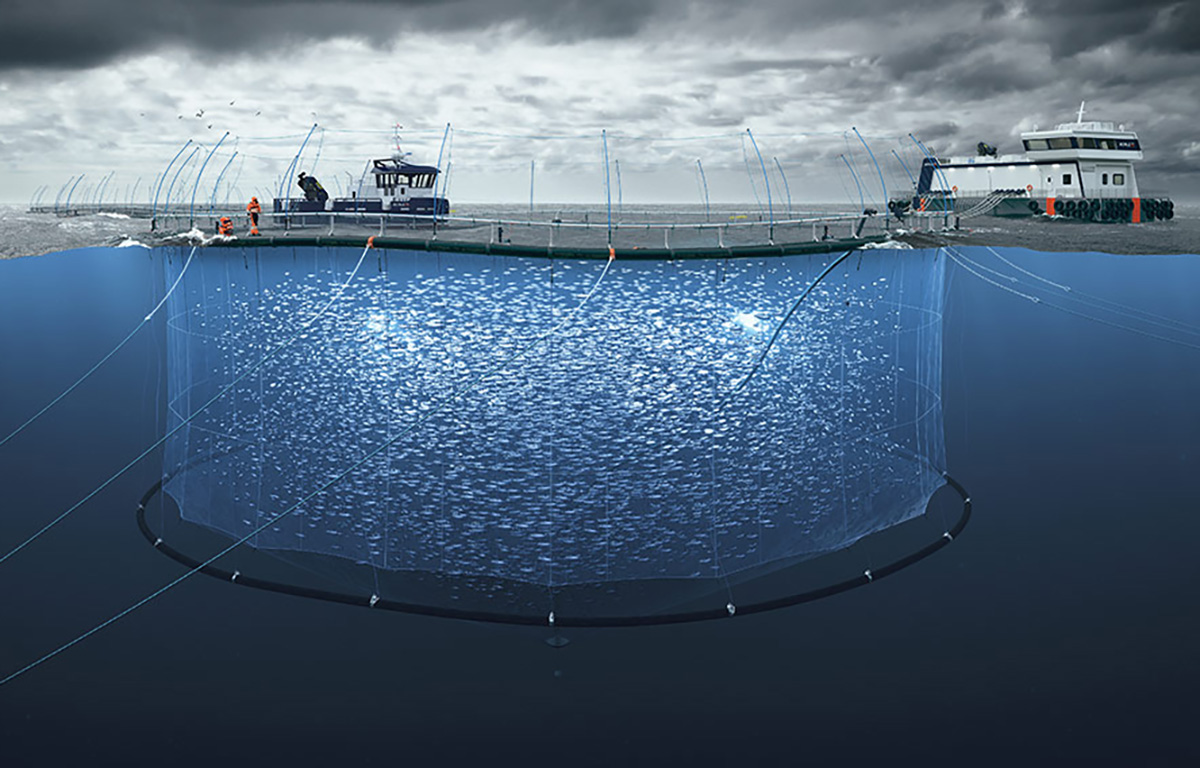

“From here, we will complete our 18-month program of rigorous benthic (seabed), seabird, and marine mammal monitoring. This will provide a baseline of information, against which we can measure the impacts of a working salmon farm,” NZKS CEO Carl Carrington said in a release. “The next step will be a ‘proof-of-concept’ phase, putting in the trial pens from June 2025. This is when it starts to get exciting from a farming point of view – building a smaller-scale pilot farm so that we can trial new infrastructure while monitoring the welfare of our salmon to ensure they can thrive.”

The company applied to the Marlborough District Council for a 35-year resource consent to build the open-ocean farm in 2019, with then-CEO Grant Rosewarne calling open-ocean farming an “incredibly exciting opportunity” for the company. At the time, NZKS said it hoped to open the farm by the end of 2020 or the beginning of 2021.

The Covid-19 pandemic put a damper on its plans, as well as the company’s bottom line. Its operating earnings before interest, taxes, debt, and amortization (EBITDA) in FY2021 dropped to NZD 10 million (then USD 7 million, EUR 6 million) compared to NZD 19.6 million (then USD 13.8 million, EUR 11.7 million) the year before. Then in FY2022, its performance dropped further, with the company posting a NZD 24.5 million (USD 14.9 million, EUR 13.7 million) loss in the first half of the year.

The losses had the company turning to a share offer to pay off debt, and it ended up reducing its staff by 20 percent to return to the black in FY2023. It suffered

That trend of hot summers has continued and is partially the driver behind ...