Chicago, Illinois, U.SA.-headquartered technology solutions provider John Bean Technologies Corporation (JBT) has made another attempt to acquire Garðabær, Iceland-based processing equipment manufacturer Marel – the third such attempt since JBT first tried to so in November 2023.

Marel nixed a takeover bid from JBT in late November 2023 that valued the company at EUR 3.15 (USD 3.43) per share. Marel also later denied a follow-up bid in December 2023 that had an enterprise value of EUR 3.4 billion (USD 3.7 billion), valuing Marel at EUR 3.40 (USD 3.71) per share – an 8 percent increase over its first offer.

Now, JBT is offering Marel EUR 3.60 (USD 3.91) per share for 100 percent of the company’s 754 million fully diluted shares – an increase of 14 percent over its initial offer in November 2023. JBT is also offering to take over Marel's existing net debt and lease liabilities of EUR 871.9 million (948 million). All told, the valuation of the deal is just shy of EUR 3.6 billion (USD 3.9 billion).

“Following a period of constructive discussions, we have received a revised proposal from JBT to enter into a merger with Marel,” Marel Board Chair Arnar Thor Masson said in a release. “The Board has carefully assessed the proposal and, whilst it continues to believe in Marel’s standalone strategy, considers that there is compelling logic in the combination for Marel’s shareholders and its stakeholders.”

According to JBT, a merger between the two companies could create annual run-rate cost synergies of more than USD 125 million (EUR 114.9 million) within three years of closing a deal, “with enhanced operational scale and double-digit return on invested capital within four to five years post close.”

“A merger of JBT and Marel would create a leading and diversified global food and beverage technology solutions provider by bringing together two renowned companies with long histories and complementary product portfolios, highly respected brands, and impressive technology,” JBT said in a release.

JBT President and CEO Brian Deck said that the latest offer comes amid continued discussions between the management of JBT and Marel.

“We look forward to working together on confirmatory due diligence and finalization of the formal voluntary takeover offer on the terms outlined,” he said.

JBT added that if the two companies merge, Deck will continue to serve as the president and CEO of the combined company.

“We have long admired Marel and are excited about combining our companies to create a leading and diversified global food and beverage technology solutions company,” Deck said. “We are committed to leveraging Marel’s culture of innovation excellence and look forward to collaborating with the Marel team to build a best-in-class talent organization.”

The third offer once again entails an irrevocable undertaking from Eyrir Invest Hf., which holds 24.7 percent of shares in Marel.

The previous offers' connection to Eyrir Invest was criticized by a different Marel shareholder: Teleios Capital. Teleios holds a 3.3 percent stake in Marel, and heavily criticized the company’s leadership following the first offer.

“It has long been clear to us that Marel’s international potential has been stifled by a beleaguered ownership structure and system of governance that do not befit an enterprise of its size and pedigree,” Teleios said in early December.

Part of that criticism stemmed from the offer coming from Eyrir Invest – which is a holding company that up until 2023 was under the control of former Marel CEO Arni Oddur Thordarson, who was, according to Teleios, “recently deposed” from his role. Teleios claimed that the offers represented a conflict of interest and that Thordarson was trying to shore up his own personal financial position.

In response to Teleios’s criticism, the Marel board said it will “continue to protect the best interests of all shareholders and wider stakeholders.”

“Marel welcomes an open dialogue with all shareholders, including Teleios,” the board said. “Marel has engaged with Teleios regularly since they have been a shareholder, as we do with our other investors, and we will continue to engage with them as we do with all our shareholders.”

The repeated takeover offers by JBT have been beneficial to Marel’s share price. On 24 November – the date Marel announced the first takeover attempt – the company’s share price increased nearly 20 percent from ISK 350 (USD 2.55, EUR 2.35) to ISK 419 (USD 3.06, EUR 2.81). Since that time, the share price has continued to increase.

The announcement of a third acquisition attempt comes soon after Marel announced its long-time COO, Linda Jonsdottir, stepped down after 15 years of tenure at the company.

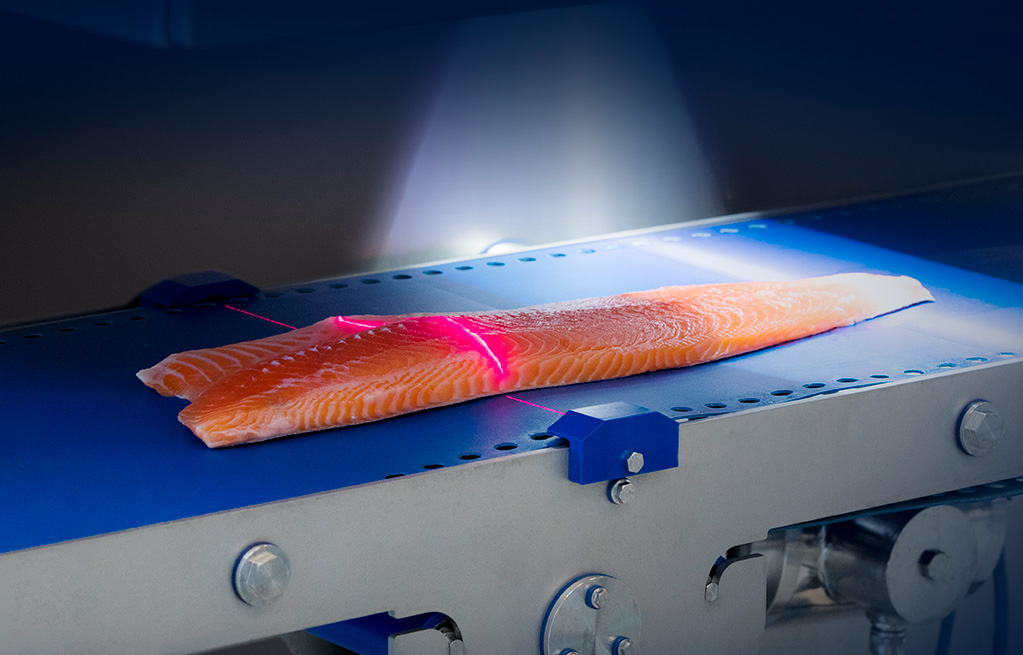

Photo courtesy of Marel