American-initiated tariffs are impacting Canadian seafood businesses in unexpected ways.

The growing trade war between the United States and its neighbor to the north began with a 25 percent surcharge on steel and aluminum initiated in May by the administration of U.S. President Donald Trump.

In reaction, Ottawa used the symbolism of Canada Day to launch CAD 16.6 billion (USD 12.6 billion, EUR 10.8 billion) in retaliatory tariffs strategically targeted to products like orange juice, yogurt, coffee, soya sauce, mayonnaise, and bourbon, which are produced in the home districts of key Republican allies of President Trump.

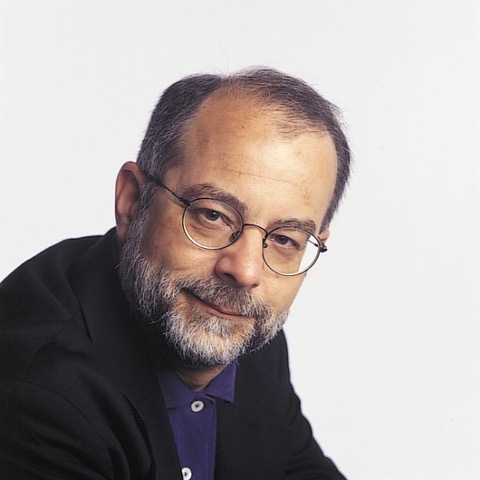

As a result of this, Galen G. Weston, CEO of Loblaw Companies, Canada’s largest food retailer, believes the trade war may result in higher prices for retail goods sold in Canada.

“We see a very strong possibility of an accelerating retail price inflation in the market,” Weston said at a recent press conference. On the upside, he added, “We don’t think it’s going to be meaningful [or] super significant, but it certainly will be higher than what it is today.”

Krishen Rangasamy, an economist with the National Bank of Canada, agreed the Canadian tariffs won’t have an overly significant impact on consumer prices. He thinks importers are unlikely to pass on higher prices and those that do will have minimal impact on the consumer price index, around 0.01 percent. However, Karl Littler, a representative of the Retail Council of Canada, suggested in the Financial Post that already-thin retail margins will mean prices have to rise, but not by the full 10 percent Canadian tariff of targeted goods.

Whether or not the tariffs translate into significantly higher shelf prices, someone along the supply chain is going to eat the actual increased costs. Since the tariffs on steel and aluminum went into effect, many soup-, soda-, and beer-makers like Campbell’s, Molson Coors, and Coca-Cola are feeling the impact of more expensive cans and planning price increases.

In the collateral damage column, the tariffs and price hikes are squeezing the supply chain for cans, making it difficult for smaller craft brewers to procure them. This shortage could impact other food processors who employ metal packaging.

Canadian businesses are also facing the added headache of having to deal with increased paperwork to be compliant with the new tariffs. There will also likely be added costs to them, as according Canadian Association of Importers and Exporters Vice President Jim Sutton, the tariffs are taxable. Sutton said they are subject to Canada’s Goods and Services Tax (GST) and require weekly filing and monthly payments.

As for seafood, sales have yet to be targeted or impacted, according to several executives interviewed by SeafoodSource. But Canada’s producers are holding their breath. Tom Smith, executive director of the Aquaculture Association of Nova Scotia, said even though 70 percent of his association’s products go to the U.S., they still enter the U.S. with zero tariff, and there has been no change to business as usual.

“We’ve looked at it, and talked to the Feds. So far there has been no impact,” he said.

If the seafood sector emerges as a tariff target, Smith said it’s his believe the damage will be limited.

“At this time we think that the worst-case scenario is the WTO tariffs will kick in at approximately 2.5 percent on certain species,” he told SeafoodSource.

Paul Lansbergen, president of The Fisheries Council of Canada, said he hasn’t heard anything from his association’s members on the tariffs.

“But that doesn't mean Canadians won't see increased prices, particularly on canned products. Some of that is imported,” he said.

On the upside for Canadian seafood businesses, the tariffs result in the opening or expansion of foreign markets to Canadian seafood. Just as Canadian consumers are showing some solidarity in stores by searching for the Canadian product over a U.S. brand, Chinese consumers may also be flexing their patriotic muscles by curbing their purchases of American goods.

“I have heard that U.S. exports of live lobster to China have collapsed due to the tariffs, with Canadian exporters picking up some of the slack,” Lobster Council of Canada Executive Director Geoff Irvine told SeafoodSource.

The U.S. market could end up with an oversupply of domestic lobster, that might end up lessening the need to import lobster from Canada. That would leave Canadian producers the option of dropping their domestic prices or stepping in to supply overseas markets such as China, Irvine said.

In related news, just as U.S. tariffs were imposed on Chinese products, a Chinese-owned seafood freight forwarding company in Nova Scotia, First Catch, began two offering additional weekly cargo flights from Halifax to Changsha, China. The company is using a Boeing 747-400 freighter capable of carrying 120 metric tons of seafood.

Tariffs may have marginal impact on store shelves, but the greater change will be the opportunity for Canadian producers as certain international markets realign and close to U.S. suppliers.

Photo courtesy of Loblaw