The Blue Marine Foundation has filed complaints with the U.K.-based Financial Conduct Authority and the Prudential Regulatory Authority, claiming London-based ship insurance companies are turning a blind eye to European Union fishing vessels skirting rules.

The complaint claims that 46 separate fishing vessels from the E.U. have engaged in “highly inconsistent” use of their automatic identification systems (AIS), occasionally “going dark” on the system, making it harder to detect their activity. The complaint is based on a peer-reviewed legal paper that Blue Marine Foundation released in January 2023 that analyzed national and international regulations on switching off an AIS in the Western Indian Ocean, The Guardian reported.

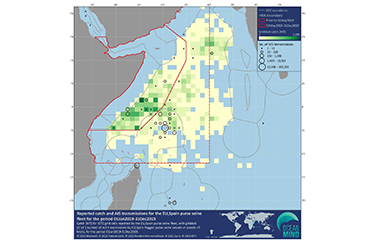

A separate study of the usage of AIS in the Western Indian Ocean, commissioned by Blue Marine Foundation and performed by OceanMind – a nonprofit providing detailed fishing monitoring – found that “significant fishing activity” was undertaken by vessels with E.U. flag states with AIS switched off. It also identified certain purse-seine vessels had extremely long gaps in AIS transmissions, varying from just over one month to over eight months between AIS transmissions.

According to Blue Marine, three British insurance firms are still insuring vessels that are engaging in questionable use of AIS. Britannia Steam Ship Insurance Association, British Marine, and MS Amlin all insure vessels with AIS problems, according to the complaint.

There are legitimate reasons for a vessel to turn off its AIS, such as to avoid detection in a high-risk area that could pose piracy risks. However vessels often go dark to engage in illegal, unreported, or unregulated (IUU) fishing, and many of the instances found in the OceanMind study were not in high-risk areas, according to Blue Marine.

Blue Marine and OceanMind also pointed out that AIS was created as a safety tool to avoid collisions – meaning refusing to use it constitutes a risk for vessels and the companies that insure them.

“The latest OceanMind report commissioned by the Blue Marine Foundation advises against insuring vessels who switch off their AIS, as evidenced in the data,” the Blue Marine legal paper states. Low transmission rates from a flag state, it said, increase risk of vessel collisions and put crew health and safety at risk.

Removing insurance from the vessels in question, could be a method of discouraging the practice and curbing IUU, according to Blue Marine. Its legal paper pointed to a December 2020 survey of insurers showing many failed to safeguard against vessels officially sanctioned for IUU fishing.

Some insurance companies, however, have signed pledges to use tools capable of tracking vessels involved in illegal fishing, and insurers have nixed coverage of problematic vessels in the past.

AS Amlin, in response to questions from The Guardian, said it has “clear controls” regarding the operations of vessels.

“We do not insure vessels that fail to comply with international maritime laws, and it is made clear to our policyholders that those breaching maritime or indeed any international law, risk rendering their policy invalid,” a spokesperson told The Guardian.

Photo courtesy of OceanMind