A native of San Francisco, Christian Molinari has lived and worked in Chile for over 20 years, after having arrived in Santiago as a volunteer and falling in love with the culture and its people. He covered business news in Latin America for over a decade, worked in communications at IBM Chile, and currently freelances in strategic communications and reporting.

Author Archive

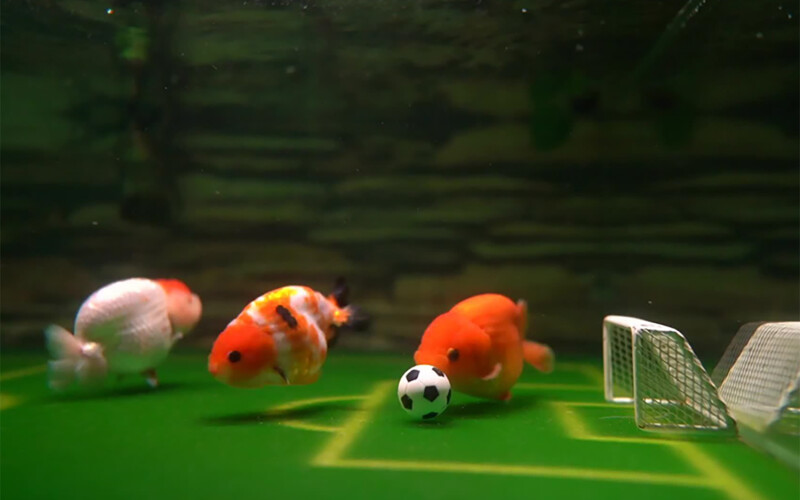

Nearly four years ago, a Chinese man posted a YouTube video that was soon picked up by larger media outlets showing how he trained his Ranchu goldfish to play soccer.

Though the video was released just a handful of months into the Covid-19 pandemic, it has recently become a trending topic in Chile – not because of the recently completed Copa America soccer tournament, during which Chile crashed out in the group stage, but because an animal

… Read MoreFuture of Fish, an international nonprofit working closely with seafood supply chains, has kicked off a pilot development fund looking to enhance the sustainability of small-scale fisher operations in Peru.

The Artisanal Fisher Development Fund seeks to make credit access more widely available to support the formalization and sustainable practices of Peru’s artisanal fishers.

Through the project, working capital loans distributed to

… Read MoreThe Peruvian anchovy-fishing industry has surpassed 98 percent of its 2.48 million metric ton (MT) total allowable catch (TAC) assigned for 2024’s first anchovy season in the country’s north-central zone, which bodes well for global fishmeal and fish oil production considering that Peru accounts for about one-fifth of global fishmeal supply.

“[We] see this as a very positive sign for the fishing and feed sectors,” IFFO

… Read MoreMany Latin American aquaculture firms look abroad to sell their farmed fish, but in Mexico, local demand for gourmet seafood is growing and should not be underestimated, according to La Paz, Mexico-based premium yellowtail fish-farming firm Omega Azul.

“The market here for premium seafood is blowing up. I’m amazed at how much we can sell here and for the price at which we can sell it, so there’s something here. Consumption of

… Read More