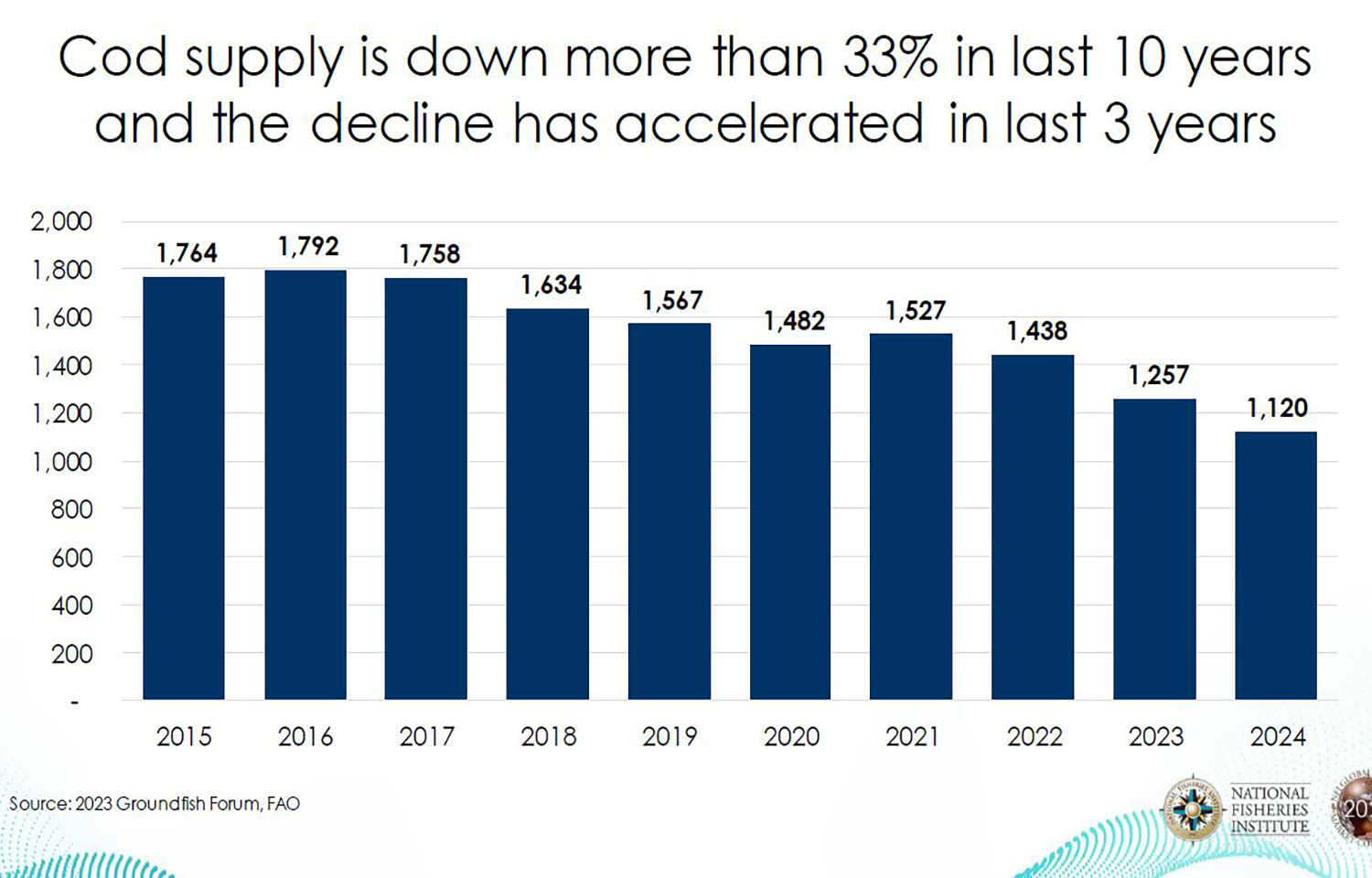

Global cod landings are down 33 percent over the past decade, and the downward trend has accelerated over the past three years.

On 25 January, at the 2024 Global Seafood Market Conference in Orlando, Florida, U.S.A., Genuine Alaska Pollock Producers Director of Industry Relations, Partnerships, and Fishery Analysis Ron Rogness reported global cod catch declined to 1.12 million metric tons (MT) in 2023.

Catches of Atlantic cod fell 42 percent over the last eight years and is predicted to be down almost 15 percent from 2023 to 2024. Pacific cod landings are expected to be relatively flat for 2024 at around 330,000 MT, according to Rogness.

Most Atlantic cod is caught in the Barents Sea by Norwegian and Russian producers, which collectively caught 761,000 MT in 2023. Norwegian production is predicted by the Groundfish Forum to drop from 296,000 MT to 216,000 MT in 2024, while Russian catches will decline from 265,000 MT to 215,000 MT. Iceland’s catch will remain steady at 211,000 MT, as will the E.U.’s catch at 41,000 MT and Faroese catch at 78,000 MT.

“According to the scientists in the North Atlantic, there's not a strong class [expected] to come in and boost those numbers in the near term,” Rogness said.

Most Pacific cod landings are caught by U.S. producers, though there was a big increase in Russian landings in 2019 and 2020. The U.S. catch is predicted by the Groundfish Forum to remain steady at 160,000 MT, while Russia’s catch will drop slightly to 105,000 MT in 2024. Japan’s catch will be flat at 56,000 MT.

“We're down to 330,000 MT for an anticipated catch in 2024,” Rogness said.

The price spread between once-frozen and twice-frozen cod fillets reached a five-year high in 2023 at USD 1.50 (EUR 1.38) per pound, with once-frozen fillets selling for USD 5.81 (EUR 5.35) per pound in November 2023 and twice-frozen fillets going for USD 4.31 (EUR 3.97) per pound. In November 2022, once-frozen fillets were selling for USD 5.46 (EUR 5.03) per pound. while twice-frozen fillets sold for USD 4.08 (EUR 3.76) per pound.

“The price spread between single- and double-frozen is expanding considerably higher than [the norm],” Rogness said.

Once-frozen cod fillet prices have moved closer to fresh fillet prices over last two years, according to Rogness. Fresh fillets are selling for USD 6.20 (EUR 5.71) per pound, down from USD 6.23 (EUR 5.74) in 2022.

“It’s surprising to me that the frozen cod price is approaching the fresh fillet price,” Rogness said.

About 10,000 MT of single-frozen fillets were imported into the U.S. in 2023 through November, compared to around 15,000 MT in 2022. Around 35,000 MT of twice-frozen fillets were imported by the U.S. in 2023 compared to around 45,000 MT in 2022.

“There were strong imports for 2022, but in both cases, the 2023 levels appear to be going back and matching what happened in 2021,” Rogness said.

Rogness noted the price for Icelandic cod and Alaska skinless/boneless shatterpacks had converged at around USD 6.60 (EUR 6.08) per pound.

“That is somewhat consistent with what we saw back in the pre-Covid days,” he said. “The other thing to note is that double-frozen prices are declining to what appears to be levels that we hadn't seen since late 2021.”

Regarding haddock, catches are projected to be relatively flat in 2024, as a projected decline in catches in Norway and Russia will be offset by a bigger Icelandic haul.

Contrary to cod, the price spread between single- and double-frozen haddock has actually grown significantly over the last year and has reached around USD 1 (EUR 0.92) per pound, up from around USD 0.60 (EUR 0.55) per pound in 2022.

U.S. import prices for double-frozen fillets dropped to USD 3.12 (EUR 2.87) in November 2023, down from USD 3.58 (EUR 3.30) in 2022. For single-frozen fillets, the price in November 2023 was USD 4.13 (EUR 3.80), up from USD 3.97 (EUR 3.66) in November 2022. For fresh fillets, the price remained nearly unchanged at USD 6.60 (EUR 6.08), up from USD 6.58 (EUR 6.06) in 2022.

"[We’re seeing] very high prices for skinless/boneless Atlantic haddock, with twice- frozen declining significantly and a huge price spread between single- and double-frozen product," Rogness said.

U.S. imports of once-frozen haddock were estimated at 3,500 MT in 2023, down from 6,100 MT in 2022, while twice-frozen haddock imports sunk to 7,200 MT from 11,800 MT in 2022.

Image courtesy of National Fisheries Institute