China and Indonesia are leading a charge that will see global tilapia production rise to over 7 million metric tons in 2024.

If the prediction from Rabobank and the Global Seafood Alliance holds true, it would be the equivalent of 5 percent year-over-year growth, and a 13 percent increase from 2019.

“Overall, the growth of tilapia has been pretty consistent with year-over-year increases, averaging about 5.4 percent each year,” Urner Barry Seafood Market Reporter Lorin Castiglione said at the 2024 Global Seafood Market Conference in Orlando, Florida, U.S.A. on 25 January. “There was a bit of a [decline] in 2020, obviously due to the pandemic, but growth has continued, although it is at a slightly slower pace [since].”

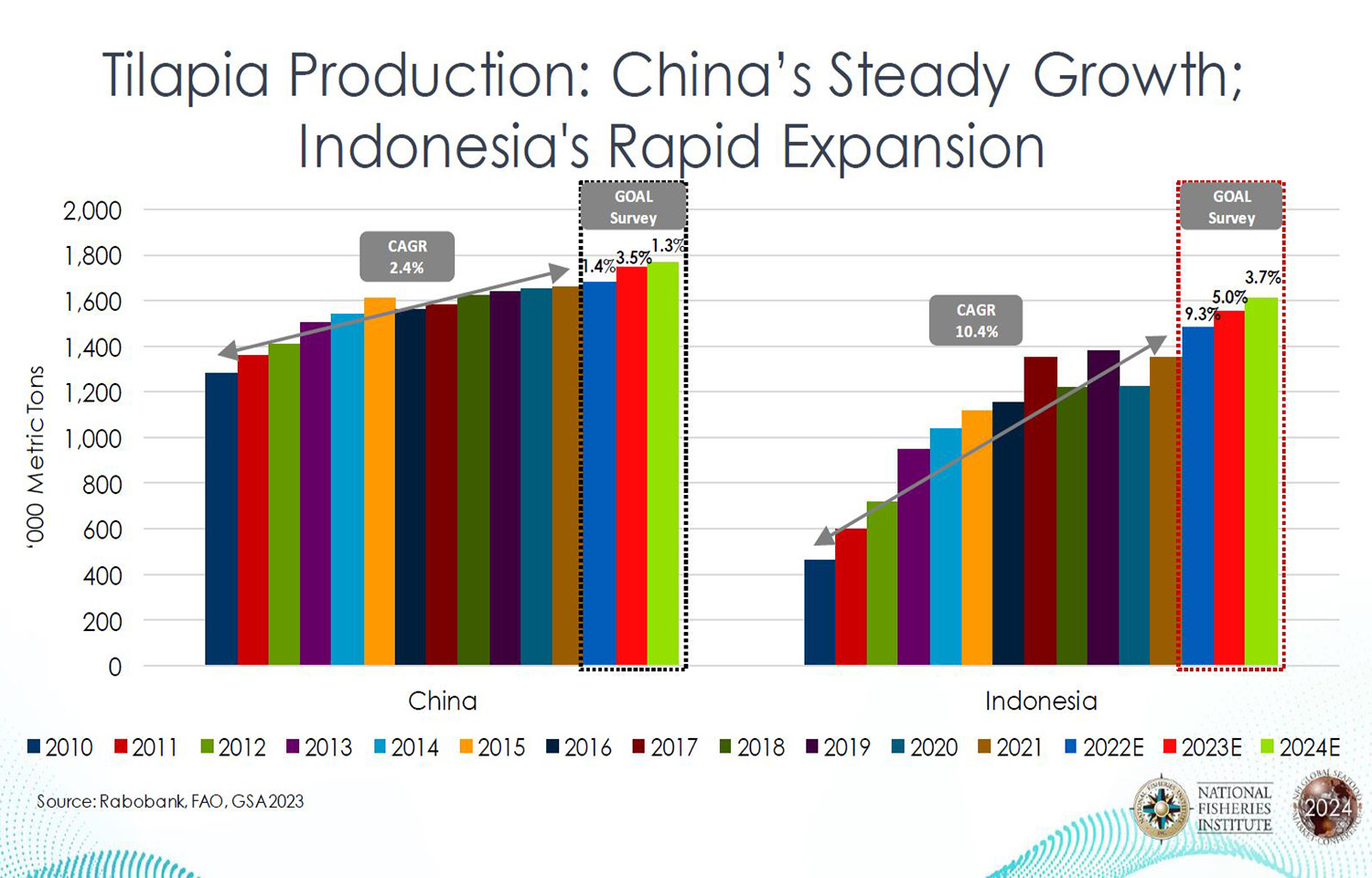

China’s tilapia industry “has entered a phase of stability,” according to Castiglione.

“We're seeing a steady but moderate growth here and that's indicating a more mature market that continues to expand at a measured pace [at] about 2.4 percent growth annually,” she said.

Indonesia's growth, in contrast, has shot up at a dramatic pace, at 10.4 percent since 2010. Estimates put Indonesia's production at 1.61 million metric tons (MT) in 2024 – approaching China’s 1.79 million MT.

Maritime Products International President Matthew Fass said as a category, tilapia “continues to be poised for continued growth.”

“But it's certainly country-dependent a little bit,” he said. “I think there are clearly some headwinds.”

The U.S. section 301 tariffs initiated by former U.S. President Donald Trump placed a 25 percent import tariff on Chinese tilapia, and current U.S. President Joe Biden has maintained all China-related tariffs since taking office.

“When you look at wholesale prices of tilapia and you translate that back to FOB prices in China, there’s tremendous price pressure there right now that’s not creating the best situation in terms of sustainable pricing and health for the farms and processors there,” Fass said. “Obviously, we are now years into some significant trade tensions with China, and that's not going away anytime soon, and that plays all the way through the supply chain.”

Fass said he thinks growth in tilapia production is slowing due to Chinese producers hedging production due to concerns about demand and pricing.

“I think there there's caution, certainly from China, about what's going on with global demand and the oversupply situation occurring across a lot of seafood markets,” Fass said. “That could create some additional growth opportunities for non-China supply chains – especially in Indonesia.”

Egyptian and pan-African production is also set to rise in 2024, and production in the Americas will grow slightly.

However, U.S. tilapia imports dropped markedly in 2023, with frozen fillet imports falling from 234 million pounds in 2022 to 187 million pounds in 2023 through November. Frozen whole fillets and fresh fillets, at 94 million pounds and 47 million pounds through November 2023, will likely be flat or slightly above 2022 totals once December’s import data is accounted for.

“Overall, for all product forms, there appears to be a general decline in recent years, particularly from that 2019 point onwards,” Castiglione said.

Wholesale prices dropped from highs in mid-2022 of between USD 3.45 to USD 3.70 (EUR 3.18 to EUR 3.41), for frozen fillets from China, to ...

Image courtesy of National Fisheries Institute