Stable supply and a hungrier Asian market provided the basis for a solid year for the North American lobster industry.

North American lobster landings are expected to be down 5 percent in 2023 once totals are released, but the resource is in excellent shape and continues to be reliable, according to a panel of shellfish experts speaking at the 2024 Global Seafood Market Conference in Orlando, Florida, U.S.A. on 23 January.

“We've been hovering right around 300 million pounds as a total category for many years after a big run-up in the 1990s and early 2000s,” Ready Seafood Vice President Andrew Daughan. “It's a wild-caught species, so you're going to have some fluctuations in landings, but year after year it has proven to be a consistent fishery.”

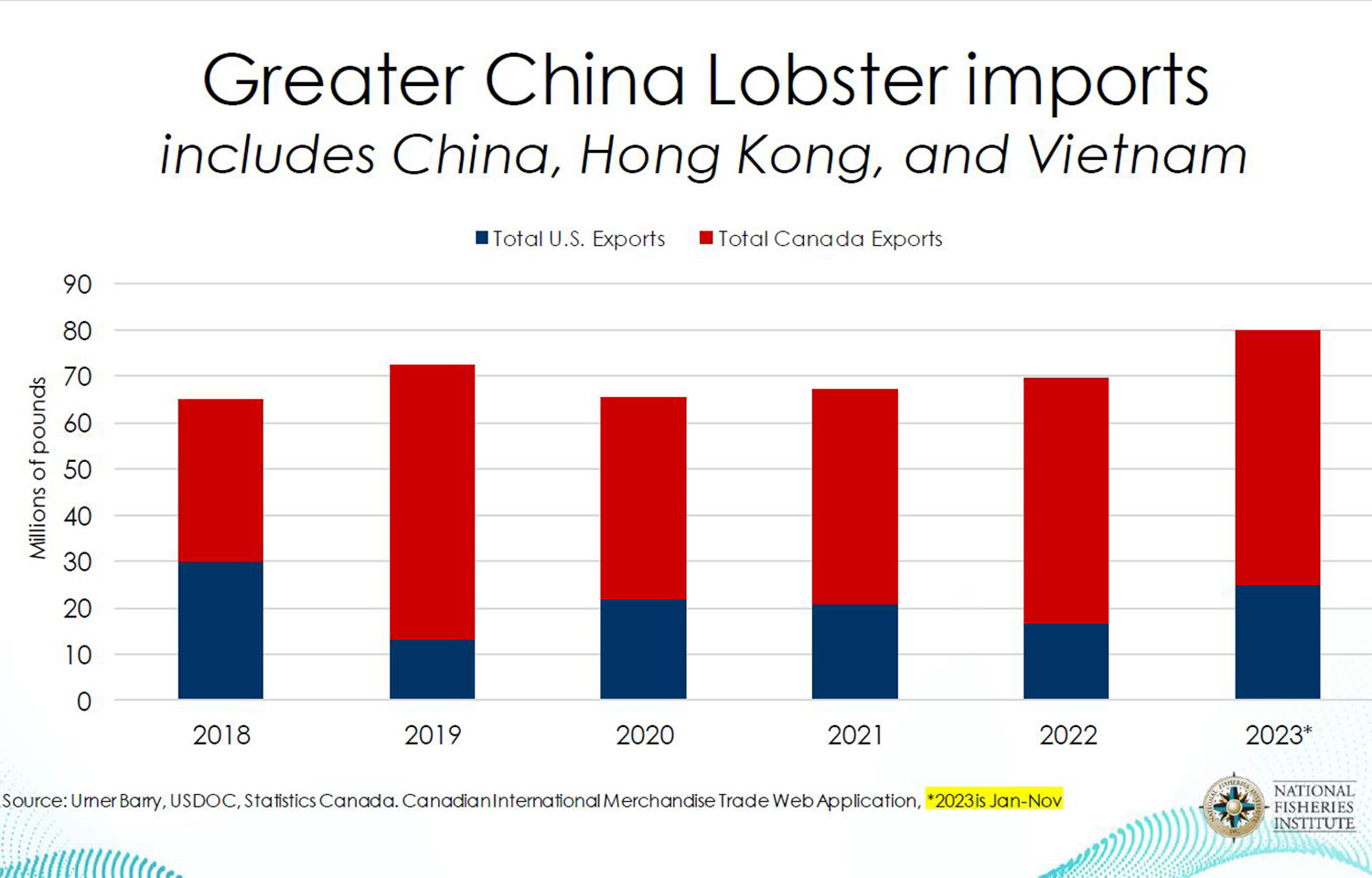

Exports to China, Hong Kong, and Vietnam fueled growth in the sector, according to Slade Gorton Director of Marketing and Business Development Annie Tselikis.

“Looking at the 2023 data, we're almost back to where we were not just pre-pandemic, but pre-trade war, which I think is pretty significant,” Tselikis said.

U.S. lobster exports to China were decimated by tit-for-tat tariffs implemented in 2018 and 2019, virtually eliminating lobster sales to China. Canada picked up some of the slack, adding direct lobster cargo flights to China from Nova Scotia, but in 2023, U.S. exports reemerged after China lifted its zero-Covid inspection regime for imported foods, as had been predicted by the 2023 GSMC panel.

“I was kind of surprised to see actually when the import numbers came in … [to see] we're actually slightly ahead of where we were the year before,” Daughan said. “You wouldn't expect that with some of the market stuff we keep hearing about … but the reality is, it’s a very steady resource and there’s very steady supply.”

Noting lobster imports from Canada into the U.S. were down in 2023, with live volumes dropping from 43 million pounds in 2022 to 34 million pounds in 2023, Daughan said a major change in the fishery is that higher interest rates are impacting lobster distribution.

"The buyers who kind of relied on the industry to hold that inventory for them and have a year-round supply, that's just not there anymore,” Daughan said. “People are just not willing to hold that inventory for the offseason like they were.”

Another potential problem, the loss of Marine Stewardship Council certification due to the fishery’s interaction with the critically endangered North Atlantic right whale, has largely been defused …

Image courtesy of the National Fisheries Institute