From Norway to North America to Chile, many of the world’s largest seafood companies are embracing the “digital data revolution.”

That term, coined by Molde, Norway-based traceability and business software developer Maritech, encompasses the use of artificial intelligence (AI) and business intelligence (BI) analytics and flexible and connected software systems, and near real-time data communication enabling forecasting all along the supply chain to swiftly match supply with demand.

“The pandemic proved the value of flexible and connected software systems in shortening supply chains, quickly revealing new windows of opportunity,” Maritech Global Services Director Kjell Jorgensen said. “With more than 70 percent of Norwegian seafood exports moving through Maritech software systems, when pandemic disruptions occurred, up-to-the-minute information flow between sales staff, packing plants, and logistics providers was critical in handling sudden changes.”

Jorgensen said the seafood industry has changed post-pandemic in “revolutionary ways.”

“As the pandemic crisis recedes, the seafood industry is waking up to a new normal. What the COVID crisis exposed were significant weaknesses up and down the supply chain, with entire fleets tying up and product stranded across the globe,” he said. “What is now clear from this unprecedented disruption is that technological innovation has been the key factor for those seafood companies who have emerged stronger, more resilient, and able to swiftly adapt to market opportunities.”

The pandemic has marked a cultural shift among consumers, Jorgensen said, as they sought out more seafood, but also paid more attention to sourcing and sustainability credentials of the products they bought.

“The importance of traceability, not only to meet regulations and perform recalls, but to tell the story of the fish, where it came from, and how, is now more important than ever. These details can only be provided though software’s ability to digitally manage and pass the data along the entire supply chain,” Jorgensen said. “When data is easily and securely transmittable and transparent, consumers gain trust in the quality and sustainability of the seafood they are consuming. And that is good for the entire industry.”

The seafood sector, post-pandemic, has a window of opportunity to redefine its industry’s best practices and processes to be more agile, flexible, and ultimately, more profitable, Jorgensen said.

And with technology becoming easier to implement and less expensive to adopt, now even small, local seafood businesses are able online tools to rapidly adjust to new markets and supply chains, according to Kristjan Kristjansson, Maritech’s manager for North American sales operations. Kristjansson cited his surprise at seeing pandemic experience success stories of a client based in the U.S. state of New Jersey that fully implemented Maritech software to manage its international seafood sales operations within one week.

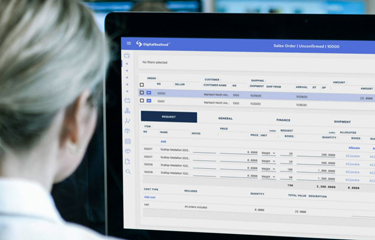

“Maritech’s cloud-based DigitalSeafood software has really meant that sophisticated digital systems that would once have been out of reach for small operators are now readily available with absolutely no huge up-front capital costs and complex IT implementation cycles,” Kristjansson said. “In addition to our core purchase and sales software suite, we provide integrations to our own solutions with labeling and packing systems, logistics, quality, claims, and IoT, as well as open, standards-based data integrations to third-party systems such as accounting, ERP, or even governmental reporting. This kind of flexibility is revolutionizing the way seafood companies can now do business.”

As part of its innovation and digital transformation strategy, Chilean salmon farmer Camanchaca has launched a project with Chilean startup Altum Lab to implement artificial intelligence (AI) to optimize business performance, harvesting times, and the handling of raw materials.

According to information from Corfo, the Chilean government’s productive investment agency, Altum’s AI platform Bruna is a Software as a Service (SaaS) web-based cloud solution that reviews all the systems-related data regarding restrictions, line production, storage, and sales capacity. Altum had detected issues regarding salmon farming harvest times and the solution “demonstrates the most effective timing for harvesting, and the network learns.”

“So, in time, it becomes more and more efficient in optimizing raw materials,” Altum Strategy Director Francisco Paredes said.

Harvest timing is of great relevance in the industry considering a high amount of variables including feeding, growth rates and costs, “so the platform delivers the harvest planning according to the existing contracts and according to the salmon sale prices for the different markets, be that Asia, Europe, wherever, and thereby [the salmon farmer can] increase profit margins,” Paredes said in a Corfo press release.

“Bruna connects the commercial world with production, which is something that hardly happens in aquaculture companies, because the people who are in operation or production are involved in the day to day while those who are in the commercial area oversee contracts and there is no fluid communication of what each area needs – [a link between] the variation in prices, especially on an international level, and what is being produced,” he said.

Camanchaca expects to improve its margins 2 to 3 percent with the implementation of the system, while also saving significant man-hours and allowing for immediate decisions to take advantage of the opportunities that arise, according to Camanchaca’s assistant planning manager, Cristóbal Carnero. He underlined the importance of harvest times, which “are a constant work in optimization, for which increasingly complex, fast, and sophisticated tools are needed."

“This is very much a changing market that is constantly adjusting and, therefore, we need tools that allow us to make immediate decisions to optimally allocate the raw material,” he said.

Camanchaca decided to work with Altum Lab after reviewing its experience in developing computing solutions.

“We already had an optimization system, but we wanted to add more characteristics and make it faster, and we realized that we needed the support of an expert company on this topic,” Carnero said.

Altum Lab, which employs AI to improve business processes and automate production, is working with the Corfo-financed innovation program Inmersíon Acuícola (“aquiculture immersion”), which was launched in October 2020 by entrepreneurial and marketing organization Sinergia Marketing and Eventos; ProChile, the country’s investment promotion agency; and salmon trade group SalmonChile. The contract with Camanchaca marks Altum’s first venture into the aquaculture industry, as it has traditionally focused on the warehousing, mining, and agriculture industries.

According to Inmersíon Acuícola Director Julio Brintrup, the contract between Altum and Camanchaca validates the purpose of the program, “which is to open up the industry to receive solutions through startups and entrepreneurs, responding to interesting challenges in the field of productivity, procedure, and management, while improving the value chain of industries that are predominant in our country.”

The program “seeks precisely to strengthen the entrepreneurship culture, through initiatives that can mitigate gaps and stimulate entrepreneurial activity,” Corfo Los Lagos Regional Director Rodrigo Carrasco said. “This is a real opportunity for an industry solution that until a few months ago was only pursued abroad.”

The contract between Camanchaca and Altum Lab is the first collaborative open innovation program in salmon farming, according to SalmonChile Technological Institute of Salmon (Intesal) General Manager Esteban Ramírez.

“This serves as an incentive to the entire industry and other activities in the south for them to trust in open innovation, open their problems, and develop similar initiatives,” Ramírez said. “We hope to have started a trend that will not stop.”

Indeed, the start-up culture and innovation seem to be taking hold in Chile’s aquaculture sector. Südlich Capital, a private investment fund manager in Puerto Varas, Chile, in the country's south, has begun raising up to USD 21 million (EUR 17.6 million) in capital for the Colonos I investment fund, with the goal of financing 10 high-potential aquaculture-focused start-ups. Colonos I is Südlich’s first venture capital fund, which is also to be supported by Corfo with two-to-one financing against investor contributions.

Founded in 1965, Camanchaca currently has nearly 4,000 employees and exports to 60 countries. Each year it harvests over 58,000 metric tons (MT) whole fish equivalent of salmonids, lands nearly 78,000 MT of horse mackerel and mackerel, and has 111 salmon and mussel farming centers, with USD 620 million (EUR 522 million) in sales.

Photo courtesy of Maritech